This is probably one of the most accurate definitions from Urban Dictionary. Bougie is also a term particularly used for black people who are of upper class status or strive to be of that.

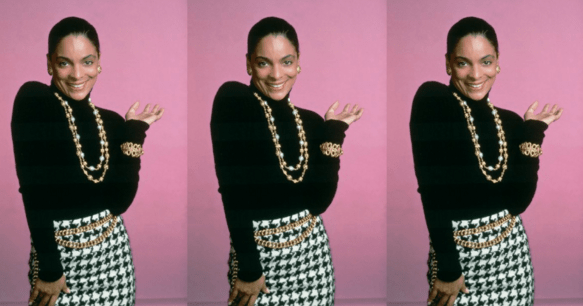

Apart of us all (kind of) want to be have the lifestyle that Hilary Banks from Fresh Prince of Bell Air has or the queen of bougie… Whitley Gilbert from A Different World attains, however, not everyone can afford the things that these characters possess.

Whitley Gilbert (A Different World)

This doesn’t mean that you cannot look the part. In this day of age, you can come close to looking expensive while keeping some money in your pocket or savings account. No one needs to know that you got the cheaper version of a purse that resembles the Versace one!

I have four items that show the example of how you can spend wisely while looking your bougiest. Who knows, you may be able to shop these items by clicking on the link! We are in holiday season so have fun shopping!

1. Real Bougie: Versace Dress, $2,150.00

The only time that you’ll see me spending this money on anything in life is for vacation and getting a new MacBook Pro… investments that will have meaning in my life. Not a dress that I may only wear once or a few times, unless I where this everyday for eternity.

Bougie Looking: Forever 21 Dress $45.90

With tax, you’re probably spending about 50 dollars which is way better for your pocket then the dress above. Plus this looks very expensive looking and chic. I just may click on the link a buy this dress. There is also the navy blue version which looks amazing as well.

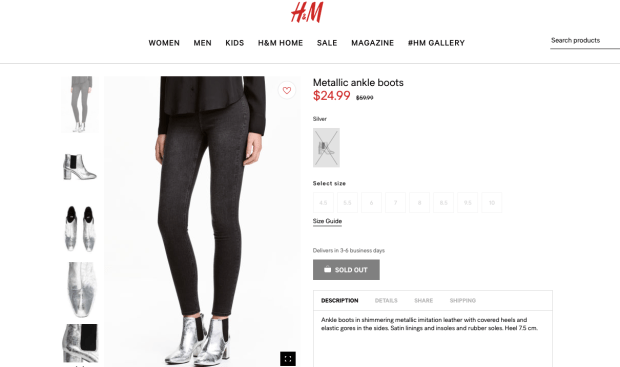

2. Real Bougie: Marc Jacobs Silver Ankle Booties $450.00

These shoes need to save my life in order to spend that money. This is also in U.S. denominations which is equivalent to $574.72 in Canadian, plus you need to add the shipping and handling and whatever expenses that need to be added. I’ll buy the knockoff version.

I’m going to warn shoppers and state that this style has sold out. For me this is no surprise, it’s under 30 dollars and it looks damn good… bougie looking to say the least. I have hope that they will restock the item so I have still highlighted the link above.

3. Real Bougie: Gucci Small Purse $4,735.00

It’s a nice purse… but not that nice for that price!

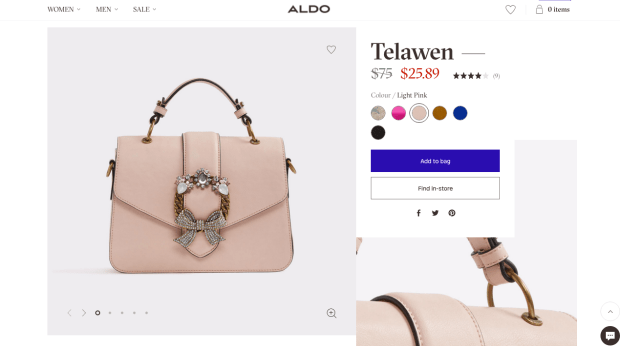

Bougie Looking: Aldo’s Small Purse $25.89

I get that there’s no gems attached to this purse, along the chains, but the style is pretty similar, plus the price is a billion times cheaper that the almost $5,000 version above. With the holidays coming along, this festive purse will go well with any outfit.

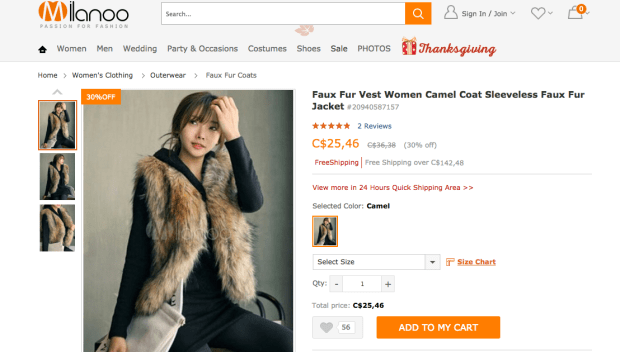

4. Real Bougie: Nordstrom Faux Fur Vest $212.25

This is a gorgeous vest but…

So is this vest, plus you can’t go wrong with the price. (Looking Bougie: Milanoo $25.46)

So there you have it, you don’t need to spend a lot to look the part. Save your money while looking great for the holidays. Feel free to click on the links that are highlighted. Until next time, happy Basic Girl Banking!